CFPB files amicus brief in support of Maine mortgage borrowers in TILA lawsuit

Housing Wire

JULY 14, 2023

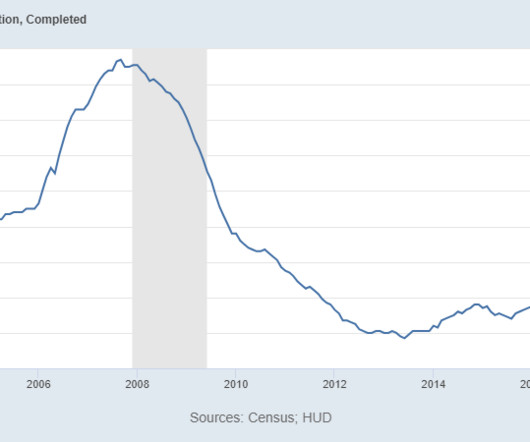

Bordick , under the federal Truth in Lending Act (TILA) on behalf of a couple that took out a mortgage in 2008 in order to purchase land for the construction of a new home. While they sold the home in 2014, the sale proceeds were not enough to cover the debt since the home lost value during the 2008 financial crisis.

Let's personalize your content