Employment gains could help housing inventory

Housing Wire

APRIL 2, 2021

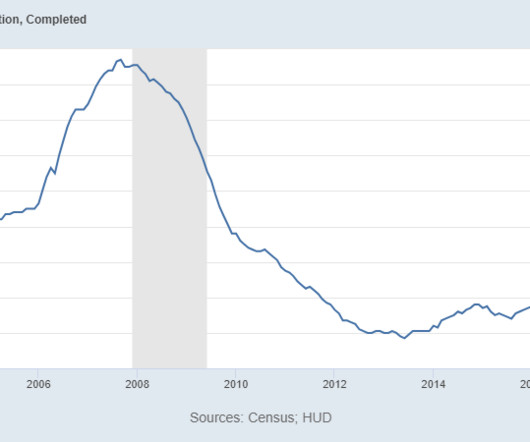

Sectors that were hit hardest by the pandemic led job growth last month, with jumps in leisure, hospitality, public and private education and construction – good signs for the housing industry. The Mortgage Bankers Association expects this heightened pace to drop unemployment numbers to below 5% by the end of the year.

Let's personalize your content