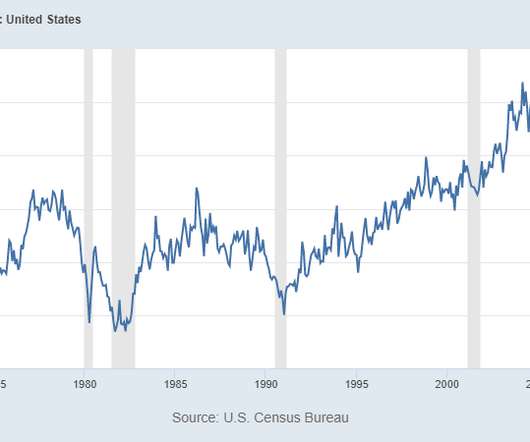

The last time houses were this unaffordable was 2006

Housing Wire

MAY 2, 2022

in February, which was the first month to see price growth greater than 20%, according to Black Knight ’s monthly mortgage monitor report. housing was the least affordable ever back in July 2006 when it took 34.1% As of mid-April, applications for ARM mortgages jumped to 8.5% Annual home price gains saw 19.9%

Let's personalize your content