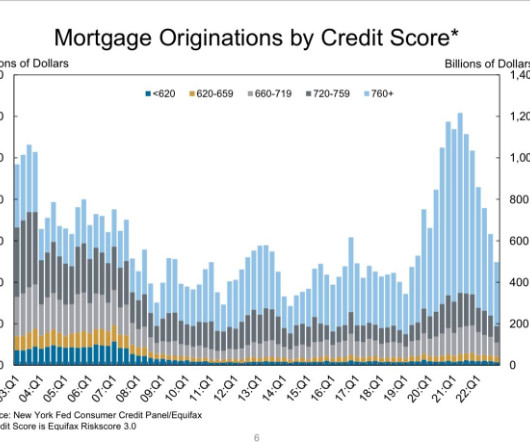

Cash-out refis reach $1.2T in 2021, highest level since 2005

Housing Wire

MARCH 4, 2022

trillion in cash-out refis in 2021, up 20% compared to the prior year, the highest volume since 2005. Despite the withdrawal, tappable equity available to homeowners with a mortgage grew by $446 billion in the fourth quarter. in 2021, highest level since 2005 appeared first on HousingWire. The post Cash-out refis reach $1.2T

Let's personalize your content