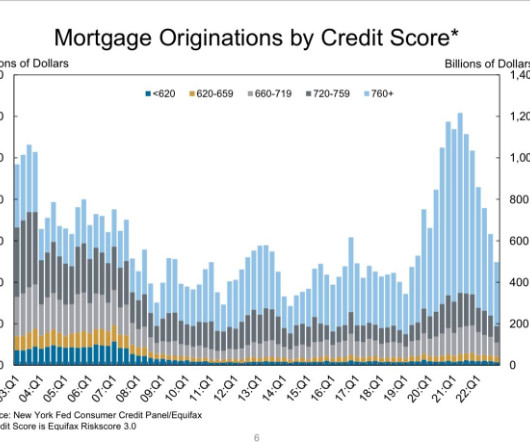

Cash-out refis reach $1.2T in 2021, highest level since 2005

Housing Wire

MARCH 4, 2022

trillion in cash-out refis in 2021, up 20% compared to the prior year, the highest volume since 2005. in 2021, highest level since 2005 appeared first on HousingWire. Record home prices in recent years have pushed tappable home equity to new heights, increasing the demand for one specific product: cash-out refis.

Let's personalize your content