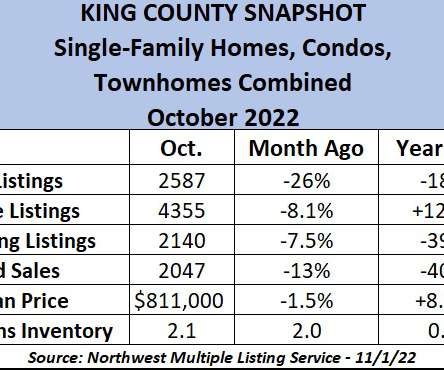

The housing market is now savagely unhealthy

Housing Wire

MARCH 18, 2022

To get the housing market to be sane and normal again, we need inventory to get back in a range between 1.52 – 1.93 million ; this is still historically low, but this gives the housing market a breather from the madness that we see today. One of the critical data lines that I want to see improve this year is days on market.

Let's personalize your content