CHLA asks Congress not to extend higher VA home loan fees

Housing Wire

NOVEMBER 10, 2022

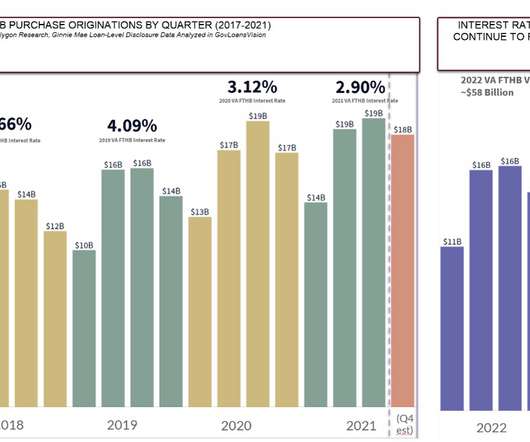

The increased fees that military veterans and active duty personnel pay for Veterans Administration (VA) mortgage loans should be allowed to expire on schedule, and congressional leaders should avoid any policies that would extend these fees, according the Community Home Lenders of America (CHLA).

Let's personalize your content