OWNS ETF taps capital markets to close racial-wealth gap

Housing Wire

SEPTEMBER 2, 2022

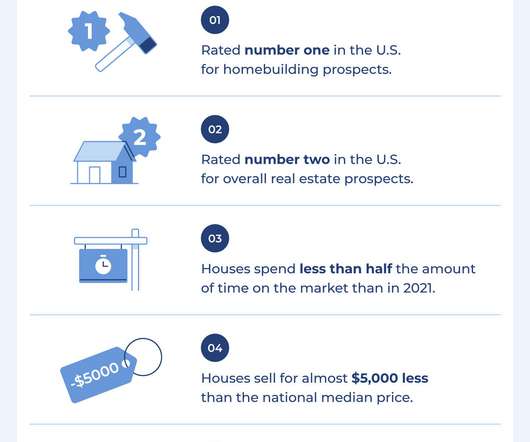

The Impact Shares Affordable Housing MBS ETF, also known as OWNS, is an exchange-traded fund with the ambitious mission of seeking to tap the capital markets to address long-standing affordable-housing and racial-wealth gap issues in U.S. In the case of OWNS, it is traded through the New York Stock Exchange.

Let's personalize your content