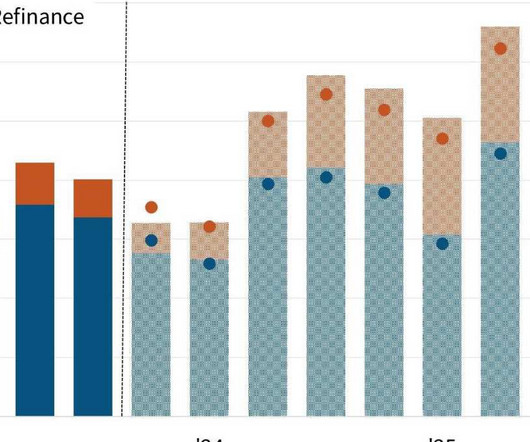

Freddie Mac’s proposed home equity product could unlock $850B in originations

Housing Wire

APRIL 19, 2024

A Freddie Mac home equity product that was proposed this week has the potential to unlock $850 billion in origination volume. Meanwhile, borrowers will be unable to refinance their first mortgage until the product is paid off, unless prohibited by law. The secondary market, however, can be a challenge for these products.

Let's personalize your content