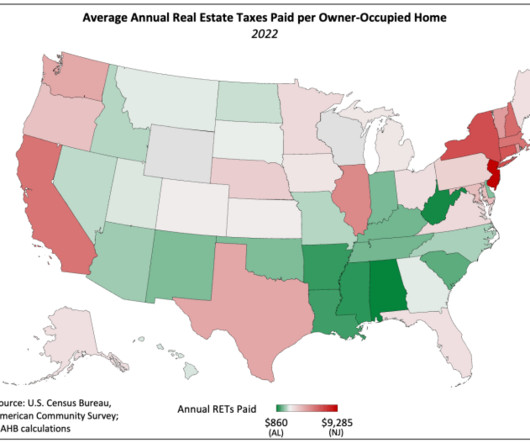

Property Taxes by State – 2022

Eyes on Housing

OCTOBER 5, 2023

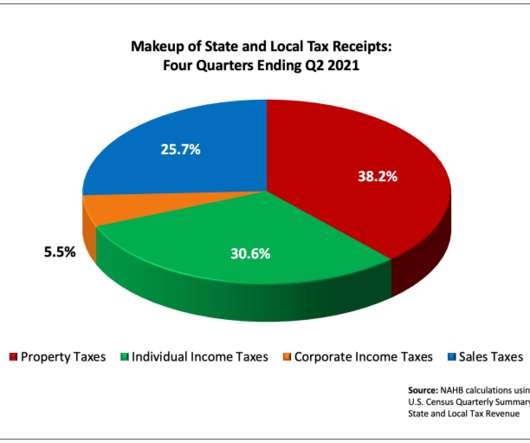

NAHB analysis of the 2022 American Community Survey data shows that New Jersey leads the nation with the highest average annual real estate tax (RET) bill ($9,285)—$8,425 more than yearly property taxes paid by Alabama’s homeowners ($860). The size of this disparity grew 1.1% in 2022 and has increased 9.3%

Let's personalize your content