No Time for Time Adjustment?

George Dell

APRIL 12, 2023

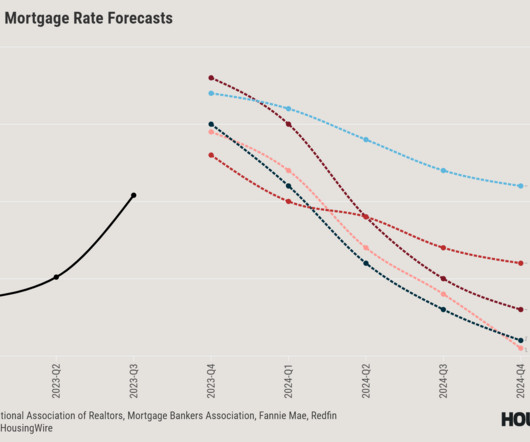

Appraiser credibility continues to decay over time. Even during the great runup in prices, and now the spotty, often rapid rundown in prices – residential appraisers mostly turned a blind eye to the need for this critical “time adjustment.” Non-residential appraisers have yet to see the coming value shifts.

Let's personalize your content