eXp and Kind plan mortgage JV by October

Housing Wire

JULY 16, 2021

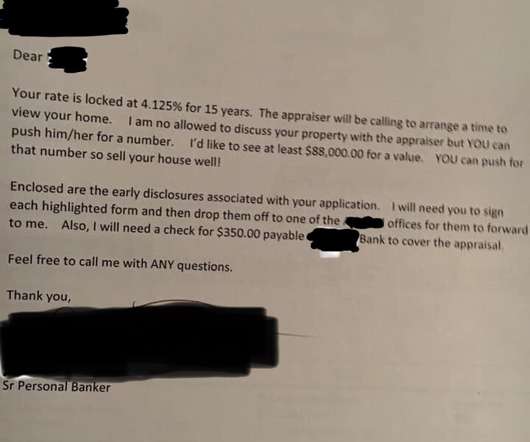

The second big mortgage joint venture announcement this week is a meeting of the Glenns. Glenn Sanford’s eXp World Holdings announced Thursday a mortgage joint venture with Glenn Stearns’s Kind Lending , called Success Lending. The Mobile “Must-Haves” Reshaping Mortgage Technology. Presented by: SimpleNexus.

Let's personalize your content