Lending association recognizes reverse mortgage vendors with awards

Housing Wire

MARCH 20, 2024

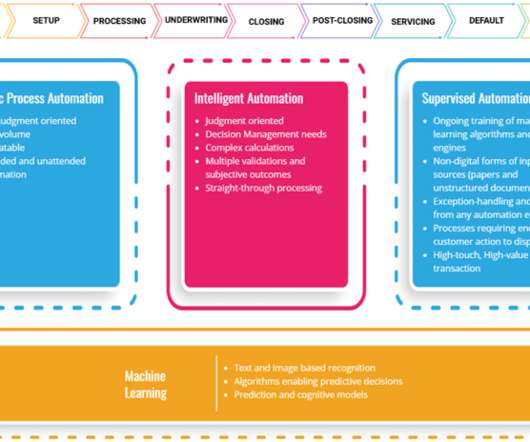

The PROGRESS in Lending Association released the names for its 2024 Innovations Award winners last week, including two vendors that are active in the reverse mortgage industry, according to an announcement. Their innovative solution supports our commitment to streamlining the lending process for our partners.”

Let's personalize your content