Mortgage rates hold steady ahead of jobs report

Housing Wire

MARCH 5, 2024

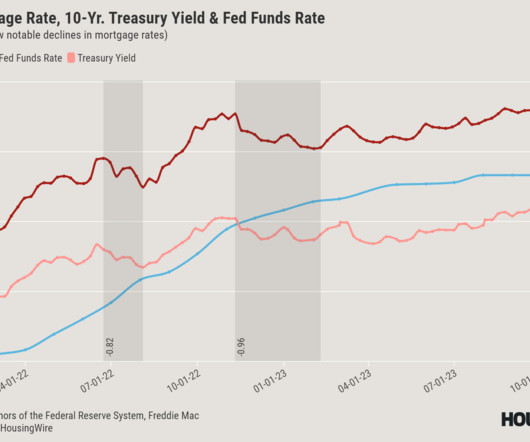

Ahead of Friday’s national jobs report, mortgage rates have found stability after increasing for multiple weeks. Polly ’s average 30-year fixed rate for conventional loans was 7.17% on Tuesday, down from 7.24% one week earlier, according to HousingWire’s Mortgage Rates Center. Meanwhile, inventory rose year over year by nearly 19%.

Let's personalize your content