Positive signs abound for 2024 housing market: ICE

Housing Wire

FEBRUARY 5, 2024

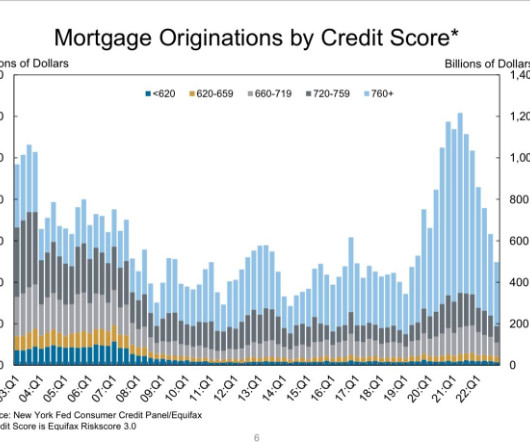

in November, which at first glance suggests an accelerating housing market. peak prior to the housing market downturn in 2006. “If On HousingWire’s Mortgage Rate Center , the 30-year conforming fixed mortgage rate was at 6.908% as of Feb. and slightly less than the 33.8%

Let's personalize your content