FHFA: Government to back mortgages up to $970,800 in 2022

Housing Wire

NOVEMBER 30, 2021

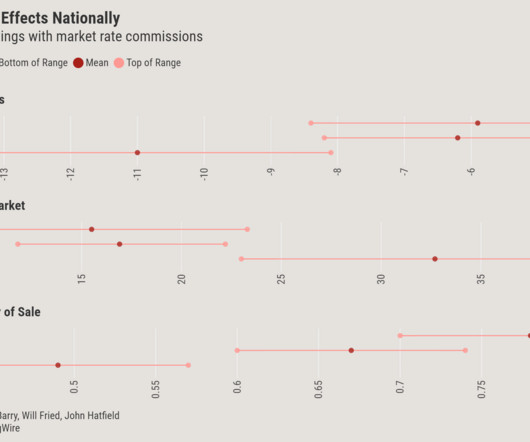

Median home values exploded across dozens of housing markets across the country in 2021. A 2008 law determines the conforming loan limits for Fannie Mae and Freddie Mac. It mandated that the baseline could only rise after home prices returned to pre-recession levels. increase from the prior year.

Let's personalize your content