DataDigest: Will work for housing

Housing Wire

JANUARY 3, 2024

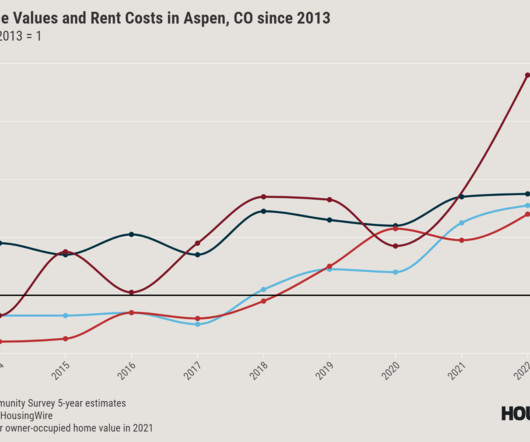

If a Colorado teacher making the average salary had $20,000 to put towards a down payment and were willing to spend 30% of their pre-tax salary on their mortgage payment, she could afford a house that cost about $225,000. When teachers can’t afford to buy homes, school districts can’t hire teachers.

Let's personalize your content