February pending home sales disappoint, but maybe we’re turning a corner?

Housing Wire

MARCH 29, 2023

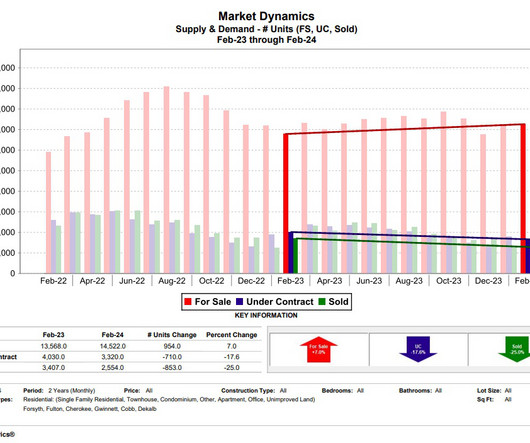

Pending home sales rose for the third month in a row in February, but at 0.8%, the uptick over January was less than is typically seen in the run-up to the spring housing market. Month-over-month, contract signings increased in three U.S. Pending home sales decreased in all four regions compared to one year ago.

Let's personalize your content