Property Tax Revenue Continues to Climb

Eyes on Housing

DECEMBER 21, 2023

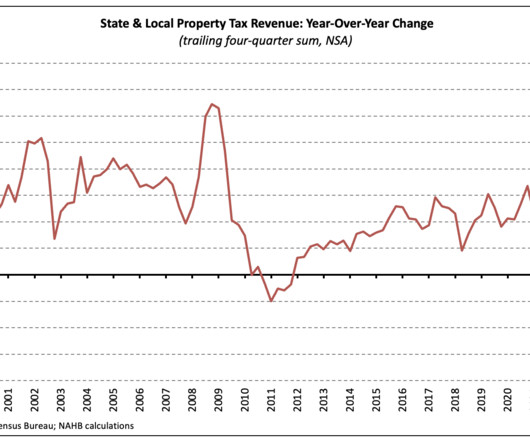

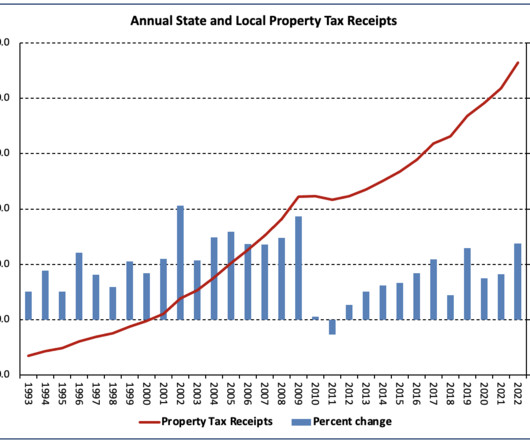

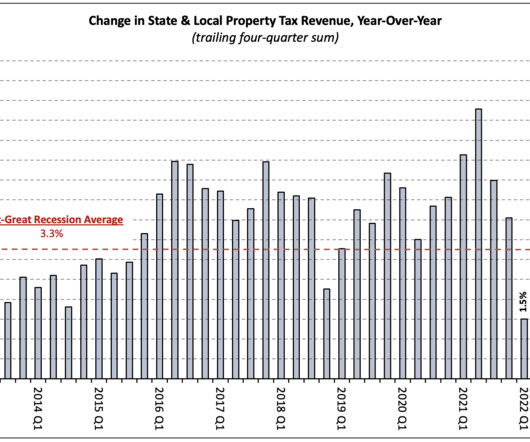

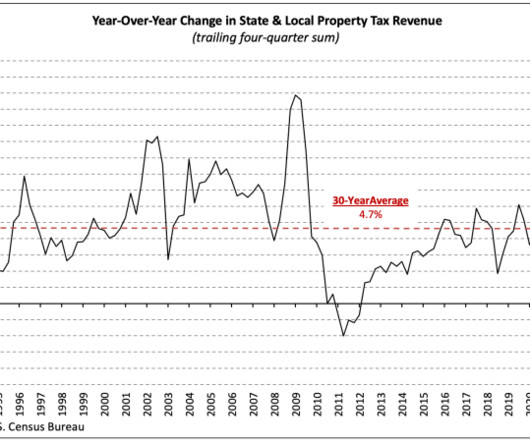

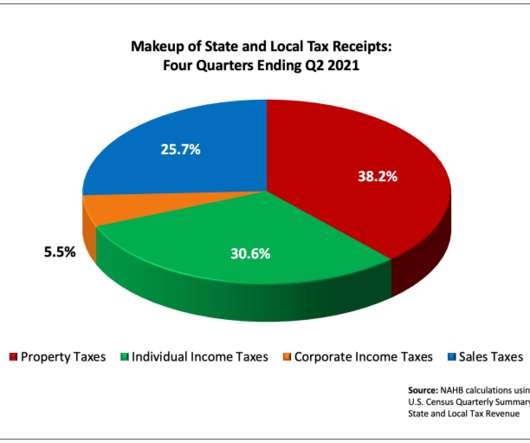

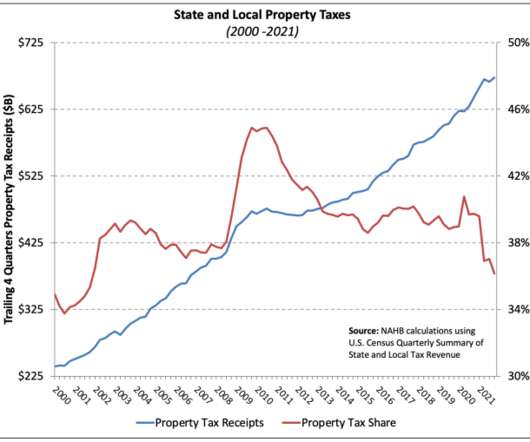

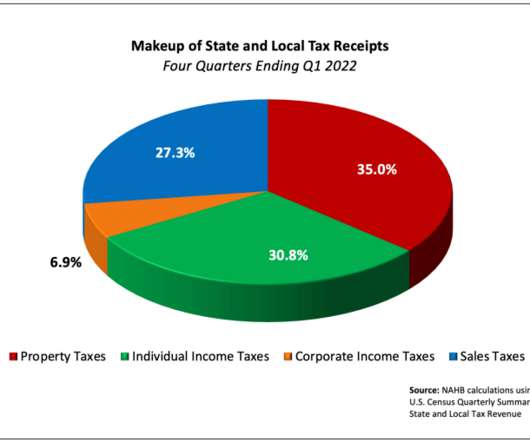

NAHB analysis of the Census Bureau’s quarterly state and local tax data shows that $129 billion in taxes were paid by property owners in the third quarter of 2023 (not seasonally adjusted).[1] 1] In the four quarters ending Q3 2023, state and local governments collected $757 billion of property tax revenue—an 11.6%

Let's personalize your content