State and Local Property Tax Revenues Eclipse $700 Billion

Eyes on Housing

OCTOBER 20, 2021

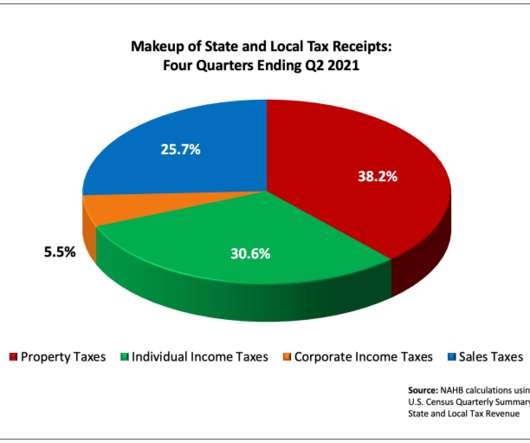

NAHB analysis of the Census Bureau’s quarterly tax data shows that $703.5 billion in taxes were paid by property owners in the four quarters ending Q2 2021.[1] 1] Four-quarter property tax revenues have climbed 13.2% since decreasing 0.2% in Q2 2020 (the first decrease since 2012). Read More ›

Let's personalize your content