Are home prices declining? What are appraisers saying?

Sacramento Appraisal Blog

OCTOBER 25, 2022

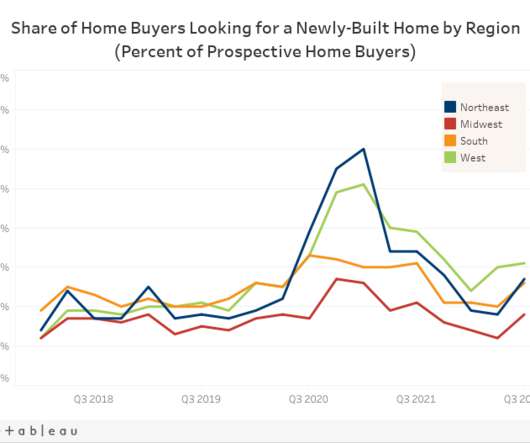

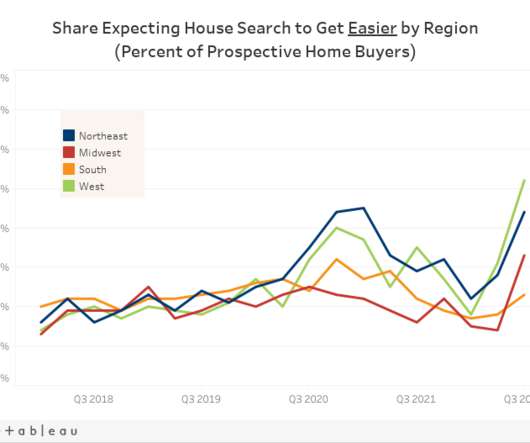

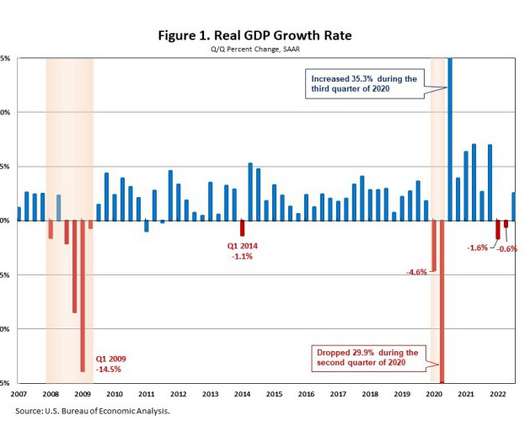

Home prices are the holy grail in real estate, and it almost seems sinful or off-limits to say they’re going down. But let’s be real. That’s what is happening right now locally and in some other portions of the country. Let’s talk about what this means as well as what’s going on in appraisal reports. […]. The post Are home prices declining?

Let's personalize your content