Home inventory uptick expected within 6 months

Housing Wire

APRIL 6, 2022

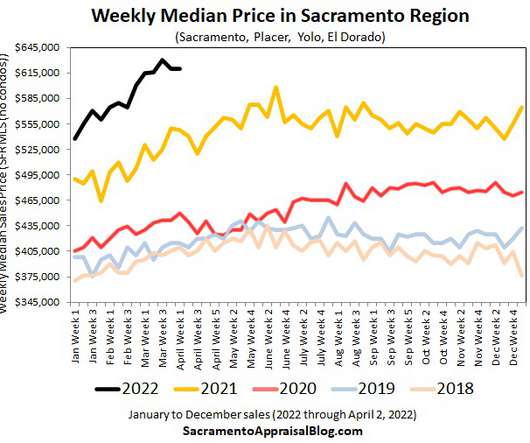

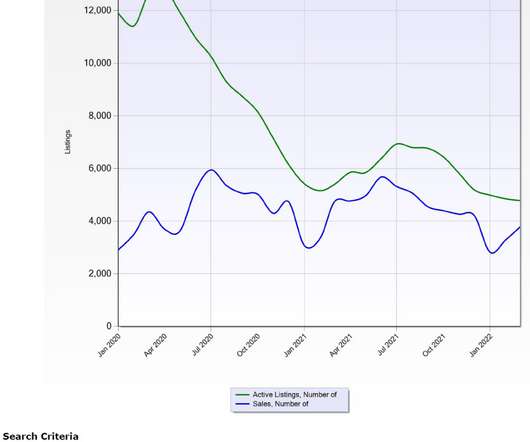

Nearly 65% of homeowners planning to sell this year expect to list by the end of summer, which should provide a much-needed influx of inventory that should slow the explosive home price growth seen during the pandemic, according to a Realtor.com survey of prospective sellers. Realtor.com Wednesday released the results of the online survey of 3,000 consumers conducted in February by HarrisX.

Let's personalize your content