Is your property tax assessment too high?

San Jose Real Estate

JUNE 3, 2023

Is your property tax assessment too high? Appealing may be an option if the value is truly incorrect.

San Jose Real Estate

JUNE 3, 2023

Is your property tax assessment too high? Appealing may be an option if the value is truly incorrect.

Housing Wire

JUNE 9, 2023

Home prices aren’t crashing, despite what the housing bubble boys are saying. In fact, home prices have firmed up higher recently. The housing bubble boys are a crew that from 2012 to 2019 screamed housing crash every year. They went all in during COVID-19 in 2020, doubled down in 2021 as the forbearance crash bros but really bet the farm on a massive home-price crash in 2023 after the most significant home sales crash ever in 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

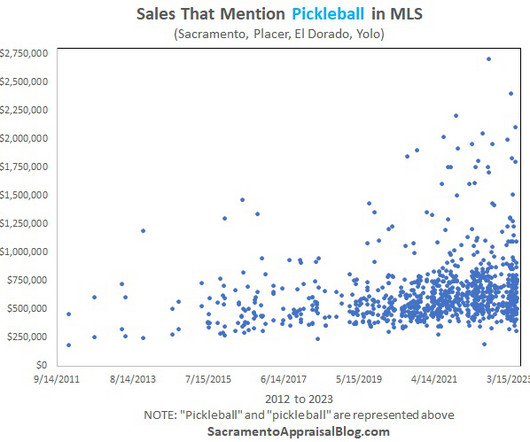

Sacramento Appraisal Blog

JUNE 5, 2023

Pickleball is all the rage, and today I want to talk about how the growth of the sport is becoming much more noticeable in real estate listings. I also have an interview with a friend who built a pickleball court in his backyard. For the record, I actually don’t play (yet), but a friend is […] The post That place where pickleball and real estate meet first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Real Estate News

JUNE 3, 2023

It's not uncommon for agents and brokers to work alongside spouses, siblings and other family members — see how they make it work + 4 tips for success.

Cleveland Appraisal Blog

JUNE 9, 2023

Hello! I hope you’re having a great summer! I am behind on my blogging for June. To get caught up, I have some returning guest bloggers who wrote some articles that I think you might enjoy. This week, I welcome back Ashley Rodriguez. In this article, she shares some pest control tips and tricks. I hope you find them useful! Photo by Pixabay on Pexels.com Pests continue to be a major concern for homeowners and business owners alike.

Housing Wire

JUNE 7, 2023

After the recent extraordinary show of force defending changes to LLPAs by federal regulators and their friends, the forest through the trees risk remains in focus to me. One of the great concerns I have, as both a former regulator and the former head of a major industry trade association, is the downside risk of keeping the GSEs in conservatorship any longer.

Property Appraisal Zone brings together the best content for appraisal professionals from the widest variety of industry thought leaders.

Real Estate News

JUNE 6, 2023

Gene Millman, the leader of Colorado's largest MLS, believes MLSs "have a bad habit of forming silos" — but by working together, they can be stronger.

George Dell

JUNE 7, 2023

USPAP requires that an appraisal is an opinion. EBV yields an analytic result. Editor’s Note: This is part IIIb of George Dell’s series on How Do I Move to EBV? Links to the earlier posts are here. USPAP (Uniform Standards of Professional Practice) is promulgated by the Appraisal Foundation, publisher of the irregularly issued rules, […] The post Appraisal Opinion vs Analytic Results?

Housing Wire

JUNE 5, 2023

The affordability challenges homebuyers are facing are becoming more deeply entrenched, according to Black Knight ‘s most recent monthly mortgage monitor report. “In a sense, the gridlocked housing market has been feeding on itself,” Andy Walden , VP of enterprise research strategy at Black Knight, said. Tightening credit availability, elevated rates, inventory shortages and strengthening home prices are adding to affordability challenges, the report notes.

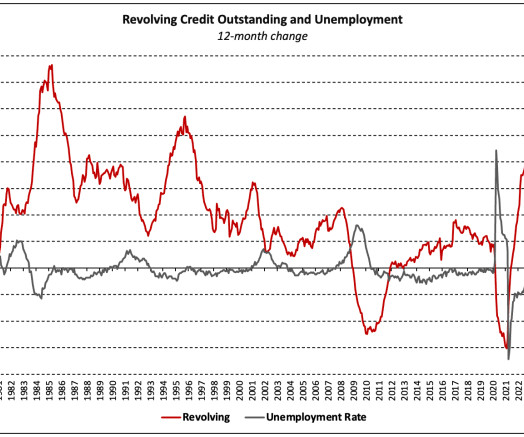

Eyes on Housing

JUNE 9, 2023

Consumer credit outstanding grew at a seasonal adjusted annual rate of 5.7% in April 2023 per the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 13.1% and 3.2%, respectively (SAAR). Total consumer credit outstanding stands at $4.8 trillion (not seasonally adjusted), with $1.2 trillion in revolving debt and $3.6 trillion in non-revolving debt (NSA).

Real Estate News

JUNE 9, 2023

Leading economist Dr. Paul Bishop and respected broker J. Philip Faranda were honored by the National Association of Real Estate Editors at their annual event.

Inman

JUNE 9, 2023

When it comes to marketing trophy properties or getting past a plateau, Aaron Kirman and Damian Hall have a few secrets to success — and they are sharing their tips with Inman.

Housing Wire

JUNE 9, 2023

Five federal agencies, including the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve , the National Credit Union Administration (NCUA) and the Office of the Comptroller of the Currency (OCC), are collectively proposing new interagency guidance on the reconsiderations of value (ROVs) for residential real estate transactions.

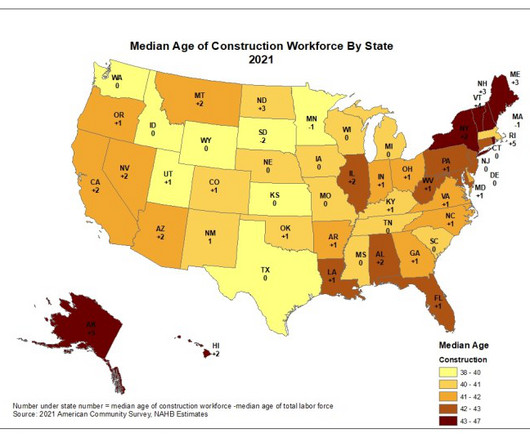

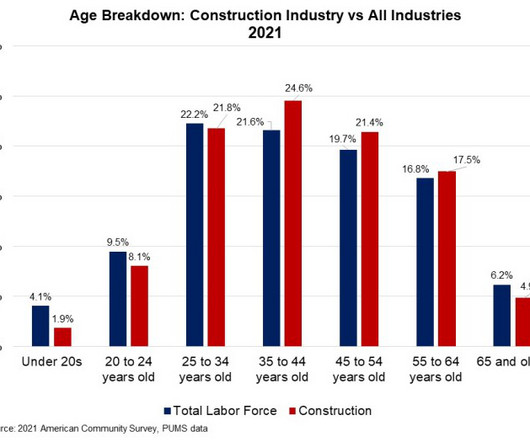

Eyes on Housing

JUNE 5, 2023

NAHB analysis of the most recent 2021 American Community Survey (ACS) data reveals that the median age of construction workers is 42, one year older than a typical worker in the national labor force. Attracting skilled labor is still the primary long-term goal for construction, even though a slowing housing market has eased some pressure on current tight labor market.

Real Estate News

JUNE 8, 2023

Home equity dipped last quarter for the first time in a decade, but big gains in recent years have kept most homeowners squarely in the black.

Inman

JUNE 9, 2023

In her first interview since the resolution of the debt ceiling crisis, Treasury Secretary Janet Yellen said that while she expects "some pain" and even consolidation, banks will weather the storm.

Housing Wire

JUNE 9, 2023

With mortgage rates still in the upper-mid 6% range, borrowers who received mortgages in May 2023 paid an average of $2,331 a month, up 20% from a year prior. That’s according to the latest origination data from mortgage tech firm Candor Technology. Per data from Candor’s underwriting engine, the average buyer in May 2023 received a loan worth about $364,094 at an average APR of 6.48%.

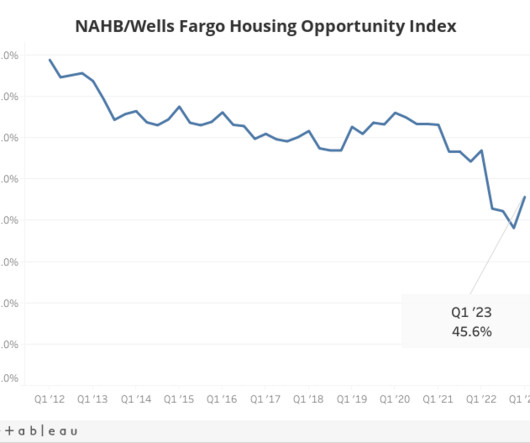

Eyes on Housing

JUNE 8, 2023

Solid nominal wage gains (unadjusted for inflation) combined with lower mortgage rates and home prices helped to boost housing affordability in the first quarter of 2023, but ongoing building material supply chain issues and expected cooling of wage growth signal ongoing concerns for affordability conditions in the year ahead. According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), 45.6% of.

Real Estate News

JUNE 9, 2023

Two of the state's top providers will no longer accept new applications, setting a grim precedent and adding another challenge for buyers.

Inman

JUNE 8, 2023

No matter how many years of real estate experience you have, thoughtfully embracing and leveraging media coverage can be a highly impactful way to amplify your brand, expand your business and gain new clients.

Housing Wire

JUNE 8, 2023

Homebuyers these days are facing much higher costs of ownership compared to a year ago, pushing most to the sidelines. Mortgage rates and home prices are high and inventory is paltry, resulting in a largely frozen housing market. Nearly two-thirds of Americans say they are waiting for mortgage rates to drop before entering the market, according to a survey released this week by BMO Financial Group , the eight-largest bank in North America.

Eyes on Housing

JUNE 7, 2023

The latest labor force statistics from the 2021 American Community Survey show that the construction industry continues to struggle to attract younger workers. While workers under the age of 25 comprised 13.6% of the US labor force, their share in the construction industry reached only 10.0% in 2021. Meanwhile, the share of older construction workers ages 55+ increased from less.

Real Estate News

JUNE 6, 2023

Black Knight reports that recent borrowers had higher credit scores and larger down payments, suggesting that lenders have tightened their standards.

Inman

JUNE 8, 2023

While Zillow remains centered on consumer search and lead generation, offspring ShowingTime+ is becoming the "super app" the industry giant promised, according to the company.

Housing Wire

JUNE 8, 2023

In this tight market cycle, strategic operational decisions can be the difference between success and failure. An aligned team of operational leaders can transition your business into the future, but first, you need the tools to get there. How are you driving your LOs to up their game? At HousingWire Annual 2023, attendees will get the inside scoop on the strategies that operational leaders, like Sarah Gonzalez, rely on to grow their businesses in any market.

Appraiserblogs

JUNE 9, 2023

On Friday morning, May 19, I was one of five expert witnesses (and the only as an appraiser) to testify on the topic of appraisal bias in front of the Appraisal Subcommittee (ASC). During the first hour of testimony, our fourth grandchild was born. My wife was in the audience and stepped out of the hearing (the nerve!) to take the call from my oldest son on the news of our new granddaughter.

Real Estate News

JUNE 7, 2023

CoreLogic reported that national home price growth slowed to just 2% year over year in April, but gains (and losses) varied locally.

Inman

JUNE 7, 2023

Adina Azarian died Sunday when the small plane she was on crashed in Virginia. Investigators are now exploring the possibility that hypoxia impacted people on the Cessna 560 Citation V.

Housing Wire

JUNE 6, 2023

With rates around 6.9% and home prices still near record highs, homebuyers are demanding that their loan officers provide options to lower monthly mortgage payments as much as possible. Michael J. Barnes, a branch manager at Mann Mortgage , recently had a client who planned to live in a new home for five years before selling it. The client requested a cost analysis to compare monthly payments on a mortgage at 7.5% versus a 6.5% mortgage rate with a permanent rate buydown.

Appraiserblogs

JUNE 5, 2023

NAR is conducting a survey and wants to know if you have any concerns regarding property data collectors, if the appraisal fees are higher since the involvement of data collectors, if borrowers are made aware of a fee for the appraisal and a separate AMC fee or were the fees bundled, if the property data collector gave the impression that they were the appraiser, whether you have any safety and privacy concerns with the data collection process, quality of data collected and whether they need to

Real Estate News

JUNE 6, 2023

As part of the government debt-ceiling deal, student loan payments that had been paused for the past three years will resume at the end of August.

Inman

JUNE 6, 2023

High property taxes in Texas have in the past canceled out some of the state's affordability advantages. But political leaders are looking for ways to reduce homeowners' tax burden.

Housing Wire

JUNE 5, 2023

Direct retail lender Revolution Mortgage has scooped up two of loanDepot ‘s top LOs, accelerating its plans to expand market share despite a tough origination environment. Jorden Brok and Brett Lotsoff are producing area managers and SVPs of mortgage lending at Revolution Mortgage and are tasked with expanding the company’s footprint in the greater Chicago area.

JMV Lending

JUNE 6, 2023

Have you ever wondered how appraised value impacts the real estate market and the homebuying process? Whether you’re buying, selling, or refinancing a home, understanding the concept of appraised value is crucial. It plays a significant role in determining the worth of a property and affects various aspects of real estate transactions. What is Appraised […] The post Everything You Need to Know About Appraised Value in Real Estate appeared first on JVM Lending.

Let's personalize your content