Improved Affordability Expectations Lead to More Engaged Buyers

Eyes on Housing

MAY 1, 2023

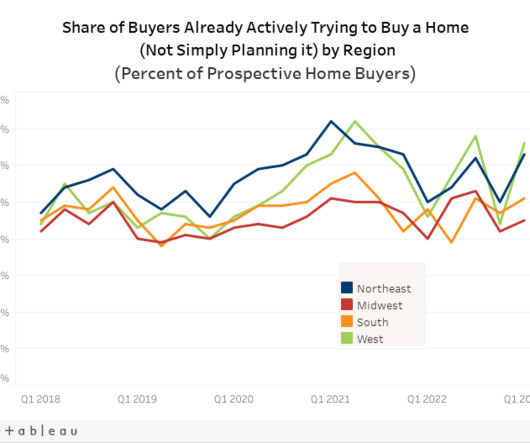

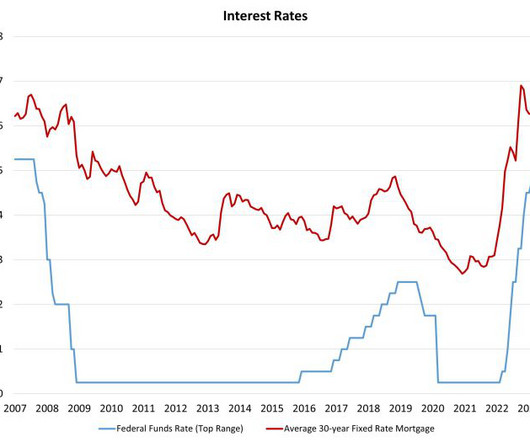

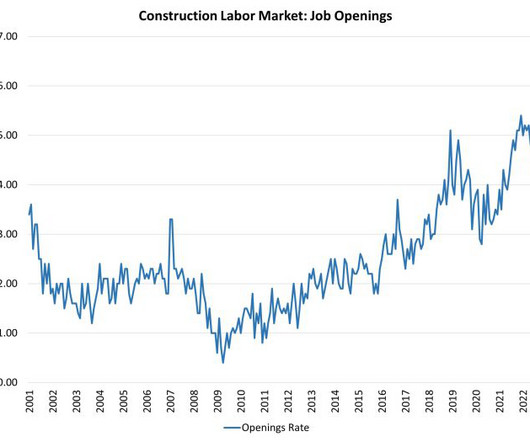

Improvements in affordability expectations have led to an increase in the share of prospective buyers who have moved beyond just the planning phase of their home search: 56% report being actively engaged in the purchase process in the first quarter of 2023, up from 46% a quarter earlier. The share of prospective buyers actively searching for a home rose in.

Let's personalize your content