No Appraisals Required. The End of Appraisers?

Appraiserblogs

MARCH 9, 2023

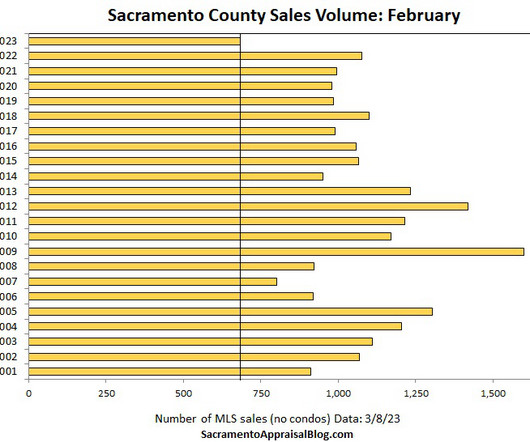

No appraisal may be required in the future! Fannie Mae took a direct shot at appraisers with the announcement of changes in their Selling Guide. Two options for the future, both of which do great harm to the appraisal industry. First, “third party” inspections. Appraisal trainees aren’t good enough, so now we will have unlicensed inspectors going through the homes of unsuspecting homeowners.

Let's personalize your content