The housing market went from an ice bath to a bloodbath

Sacramento Appraisal Blog

MAY 9, 2023

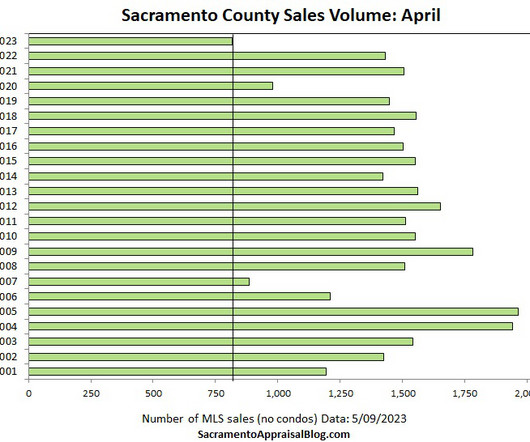

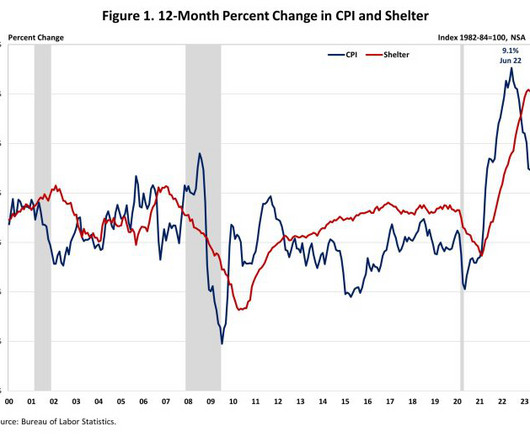

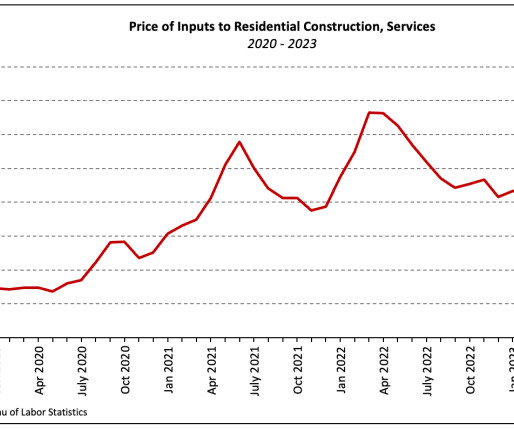

The housing market went from an ice bath to a bloodbath. That’s a good way to describe it as the contrast between the dull fall season and the spring has been striking. In today’s post I want to highlight national vs local stats, a dead cat bounce, and dive deeply into local trends. I hope […] The post The housing market went from an ice bath to a bloodbath first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Let's personalize your content