New home sales proving Wall Street was wrong

Housing Wire

APRIL 25, 2023

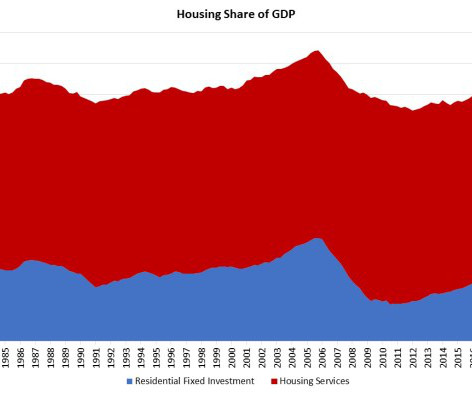

Why are the homebuilder stocks up so much? Don’t they know the new home sales apocalypse is here? You know, the one that says we have too much inventory and millions of vacant homes in the U.S.? According to this theory, we have more homes under construction than any time in history. The truth is, it’s not 2008 all over again. I understand the lure of the housing 2008 story.

Let's personalize your content