The housing market went from an ice bath to a hot shower

Sacramento Appraisal Blog

JANUARY 30, 2023

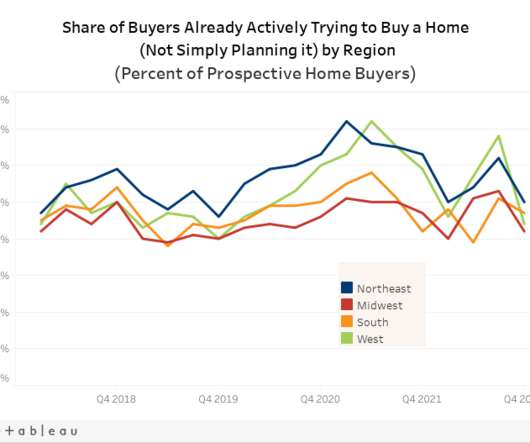

The housing market is getting hot again for the spring. It went from an ice bath in the fall to a hot shower so far in January. It’s not scalding like 2021, but it’s been a striking change. Let’s talk about this. UPCOMING (PUBLIC) SPEAKING GIGS: 2/8/23 SAFE Credit Union “Snacks & Facts” (for RE) […] The post The housing market went from an ice bath to a hot shower first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Let's personalize your content