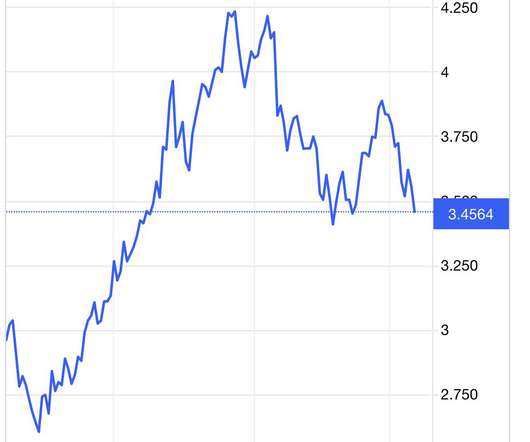

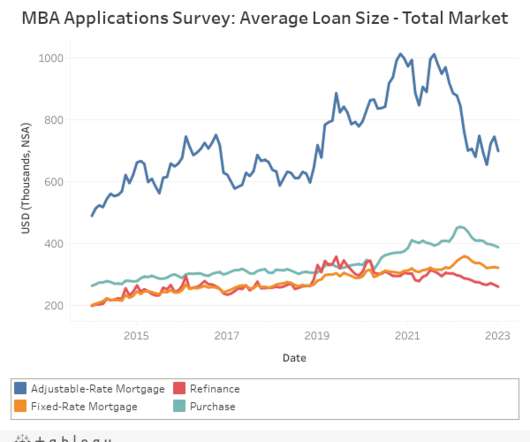

Mortgage rates have peaked along with inflation

Housing Wire

JANUARY 12, 2023

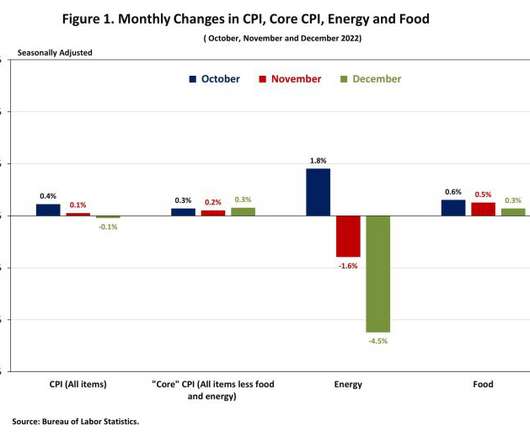

Today’s inflation data has shown that the peak growth rate of inflation is behind us. This should also mean mortgage rates hit their highs. The key phrase I have stressed since I wrote about the case for mortgage rates to go lower on Oct. 27 is thinking 12 months out. The trend is your friend, and the month-to-month data has cooled off noticeably. That cooling happened even with the biggest inflation component — shelter inflation — still rising in the lagged modeled CPI data.

Let's personalize your content