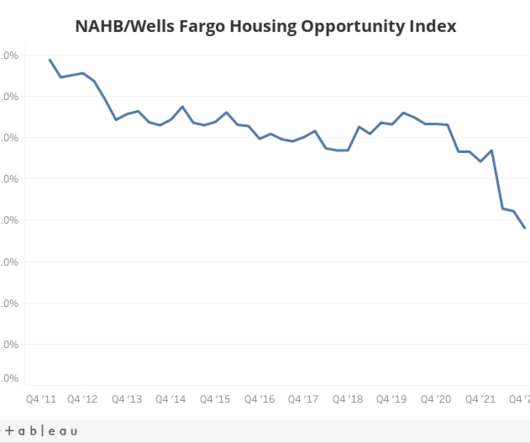

Housing Affordability Hits Record Low but Turning Point Lies Ahead

Eyes on Housing

FEBRUARY 9, 2023

Mirroring a steep rise in mortgage rates that began in the early part of 2022 and coupled with ongoing building material supply chain bottlenecks that increased construction costs, housing affordability posted three consecutive quarterly declines in 2022 and now stands at its lowest level since the National Association of Home Builders (NAHB) began tracking it on a consistent basis in.

Let's personalize your content