Rates Recover After Bumpy Week; Realtors See Prices Moderating; Stubbornly High Construction Costs

Appraisal Buzz

AUGUST 13, 2021

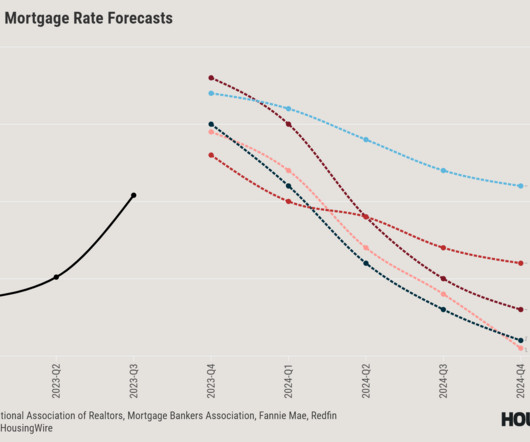

Mortgage rates bounced at 6 month lows early last week and moved higher at a faster-than-normal pace through the middle of this week. The post Rates Recover After Bumpy Week; Realtors See Prices Moderating; Stubbornly High Construction Costs appeared first on Appraisal Buzz. The University of Michigan, which has.

Let's personalize your content