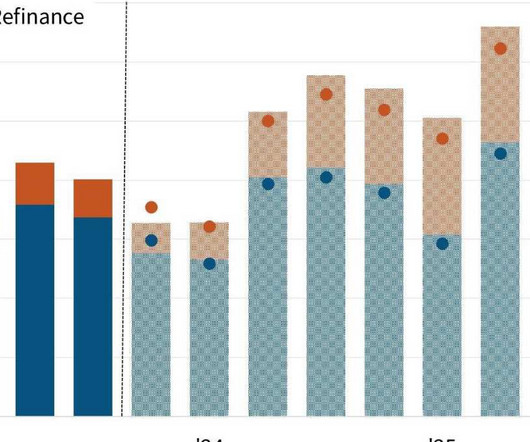

Fewer people are submitting mortgage applications

Housing Wire

JUNE 2, 2021

Tight housing inventory, obstacles to a faster rate of new construction, and rapidly rising home prices continue to hold back purchase activity,” Kan said. “The government purchase index declined to its lowest level in over a year and has now decreased year over year for five straight weeks.

Let's personalize your content