Why investors believe CoStar holds a big advantage post-NAR settlement

Housing Wire

MARCH 20, 2024

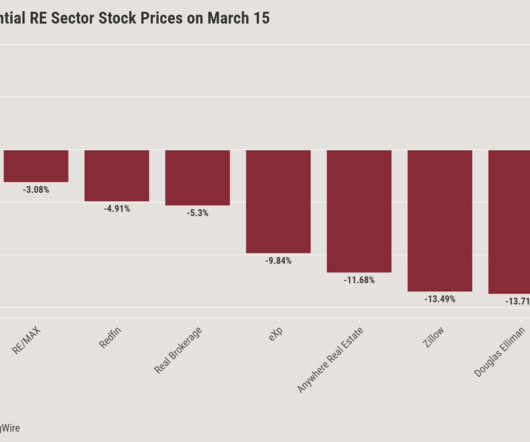

The opposite trajectories of their stock prices seem to reflect investor appetites for their different business models. Last December, Zillow netted 105 million unique visitors, according to Comscore data cited in Zillow’s investor materials. Zillow For years, Zillow has dominated online home listings.

Let's personalize your content