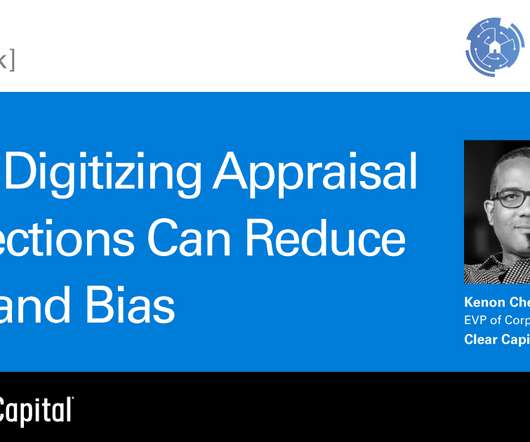

Lenders see appraisal modernization as a top priority

Housing Wire

MAY 24, 2022

A Fannie Mae survey published in mid-May found that mortgage lenders see value in appraisal modernization, specifically in the implementation of non-traditional appraisals and inspection-based appraisal waivers. One mid-sized lender echoed the opinion of others that appraisals still take too long.

Let's personalize your content