Pending home sales surged in December: NAR

Housing Wire

JANUARY 26, 2024

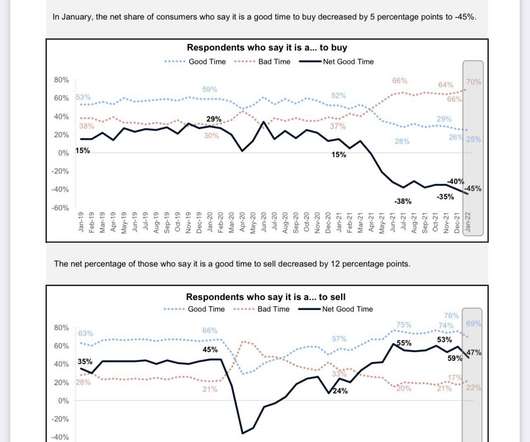

The housing market is off to a good start this year, as consumers benefit from falling mortgage rates and stable home prices,” NAR chief economist Lawrence Yun said in a statement. New home sales , another measure of contract signings, rose 8% in December on the back of declining mortgage rates. in 2025 to reach $405,200.

Let's personalize your content