Are home sellers finally coming back to the market?

Housing Wire

DECEMBER 19, 2023

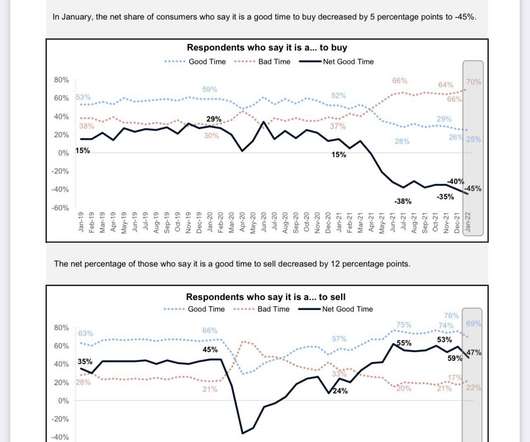

The defining characteristic of the 2023 housing market has been dramatically fewer home sellers than any recent year. The inventory picture There are now 539,000 single-family homes on the market unsold, which is up 3.2% Housing inventory climbed late in the year as mortgage rates rose. than last year at this time.

Let's personalize your content