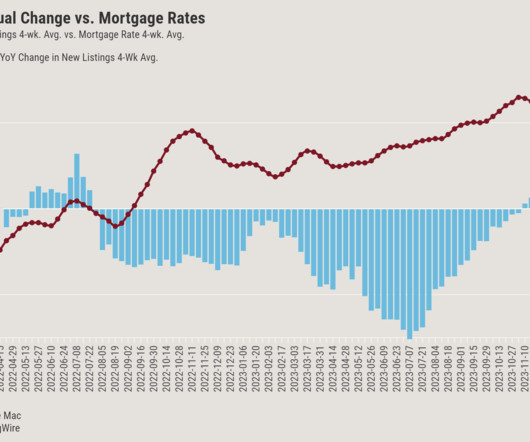

The mortgage rate lock-in didn’t start in 2022

Housing Wire

MAY 15, 2024

This is an excerpt of a HousingWire Research report titled: What Everyone Needs to Know about Mortgage Rate Lock-in, by Altos President Mike Simonsen. housing market saw dramatic changes in affordability as mortgage rates skyrocketed 500 basis points. That’s a swing of 17% fewer sellers in just a matter of days.

Let's personalize your content