2023: A year of retrenchment for the secondary mortgage market

Housing Wire

DECEMBER 13, 2023

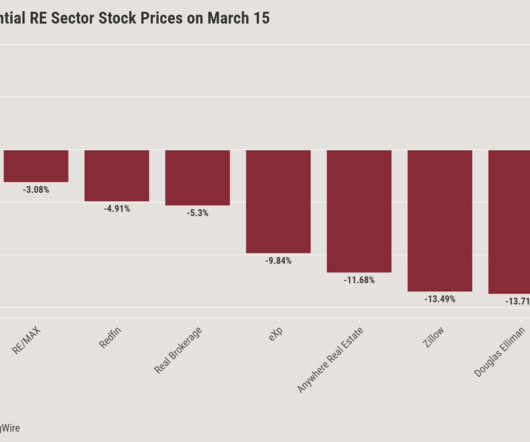

As 2023 winds to a close, so too does a brutal year for the housing market, a year marked by rising rates , steep home prices , scarce inventory and anemic mortgage originations, compared with the boom years of 2020 and 2021. percentage points in early December, when historically that spread has ranged between 1 to 2 percentage points.

Let's personalize your content