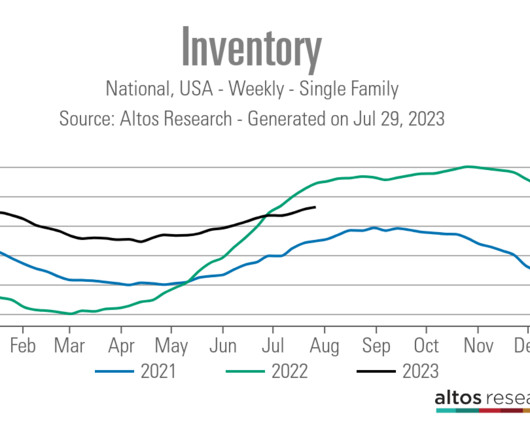

Housing Market Tracker: Inventory disappoints again

Housing Wire

JUNE 11, 2023

After seeing disappointing inventory growth two weeks ago , which I chalked up to the Memorial Day holiday, I was hoping for a big push in active listings last week, but that didn’t happen. And, the recent uptick in mortgage rates to almost 7% slowed purchase application data again. First, it took the longest time in U.S.

Let's personalize your content