Title insurance industry volume rises 3.6% in Q1

Housing Wire

JUNE 21, 2022

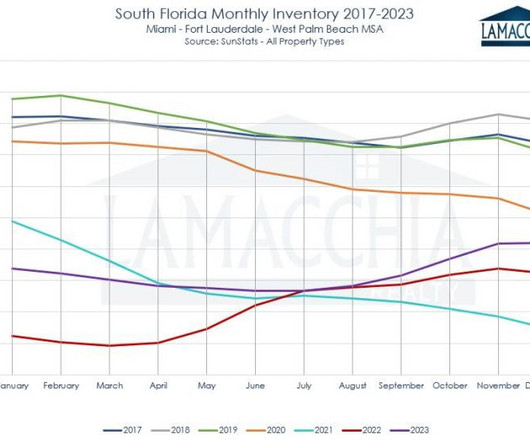

billion in title insurance premium volume during the first quarter of 2022, compared to $5.68 The title insurance industry had a record year in 2021 , generating $26.2 billion in premiums, which ALTA attributed to historic mortgage origination activity and the substantial increase in home values. Doma Title Insurance Co.

Let's personalize your content