DataDigest: Construction costs easing for homebuilders

Housing Wire

JANUARY 17, 2024

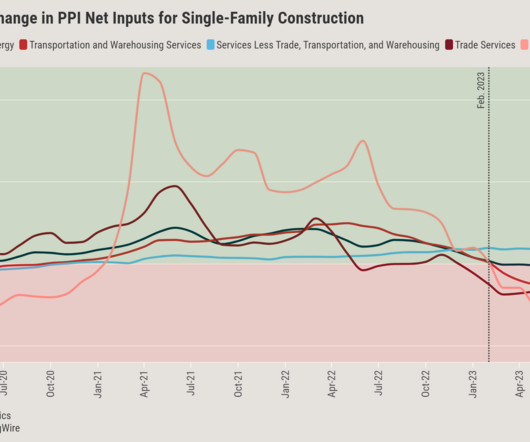

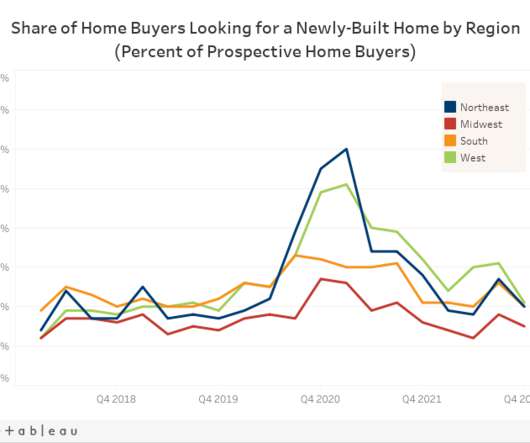

New home construction exploded early in the pandemic as soaring home demand squeezed existing inventory nationwide, giving homebuilders a much bigger share of a shrinking pie. High mortgage rates and home prices quelled the surge in buyer demand, and time seems to have moderated the supply chain shocks.

Let's personalize your content