Number of price cuts drops as housing inventory rises

Housing Wire

JANUARY 13, 2024

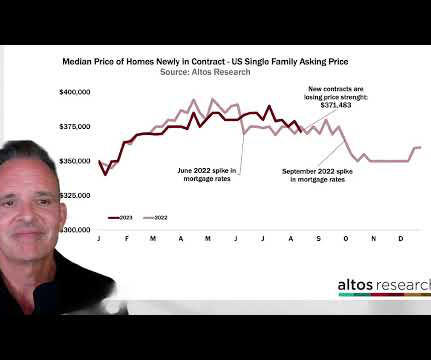

Last week, housing inventory grew and the number of price cuts fell, which is expected at this time of the year. I hope the next thing we see is housing inventory grow at the level it typically does in January or February instead of being delayed until March or April. 2022 21.7% 2022 21.7%

Let's personalize your content