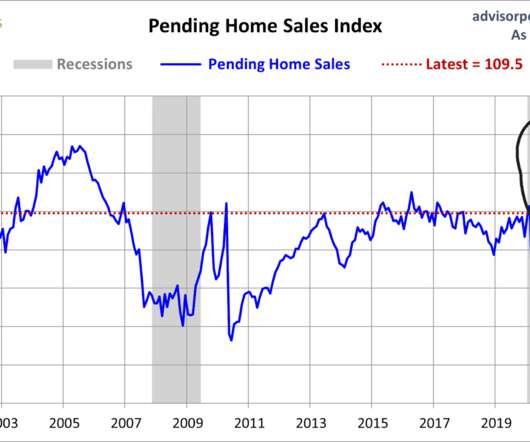

Pending home sales continue to slip as 2021 approaches

Housing Wire

DECEMBER 30, 2020

year-over-year, according to a report from the National Association of Realtors. Year-over-year, contract signings increased by 16.4%. As 2021 approaches, Yun predicts that there will be a slight uptick in mortgage rates to around 3%, existing-home sales to increase by roughly 10% and new home sales to increase by 20%.

Let's personalize your content