Buyers can afford more expensive homes on the back of lower mortgage rates: Redfin

Housing Wire

JANUARY 29, 2024

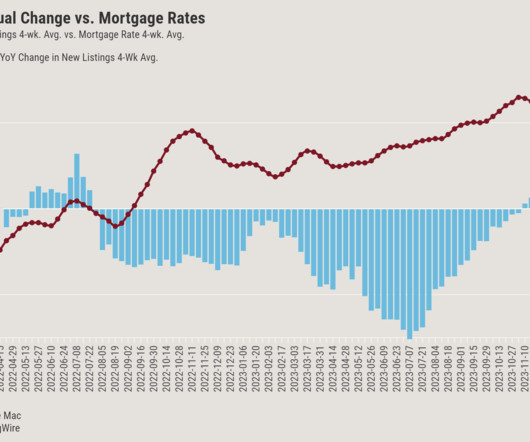

Homebuyers are getting some relief in 2024 as mortgage rates recede from their 20-year high point of last October. mortgage rate, the prospective buyer with a $3,000 budget can afford a $453,000 home. In October, a buyer with the same monthly budget and a 7.8% mortgage rate could have afforded a $416,000 home.

Let's personalize your content