Home prices are dropping like it’s 2009

Housing Wire

OCTOBER 3, 2022

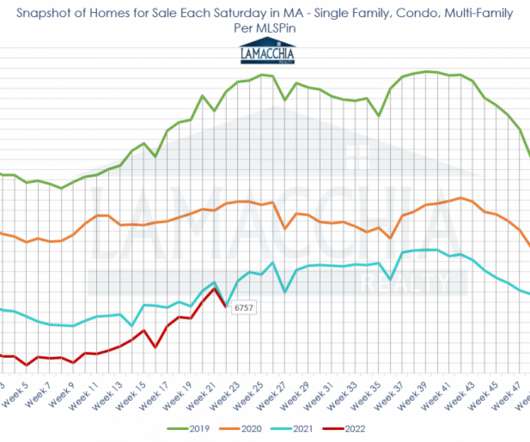

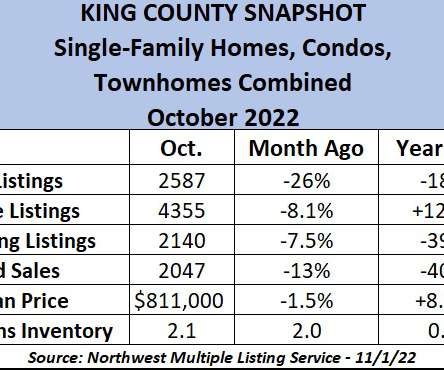

Skyrocketing mortgage rates – now in the 7% range for some buyers – and limited inventory have driven mortgage affordability to its lowest levels since the early 1980s, a reversal from the frenetic boom in buying during 2020 and 2021. Much of that depends on how much inventory returns to the market. With mortgage rates at 6.7%

Let's personalize your content