Housing inventory has never been lower

Housing Wire

DECEMBER 2, 2021

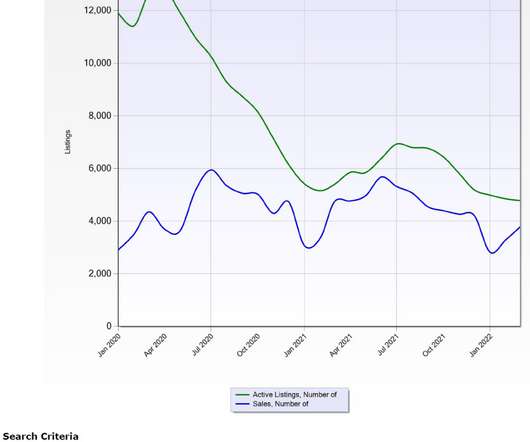

During the four week period ending November 28, the number of active listings was a 23% decrease compared to the same time period in 2020 and a 42% drop compared to 2019. The number of new listings was also down compared to 2020, dropping 4%, but it was 12% higher than the number of new listing during the same time period in 2019.

Let's personalize your content