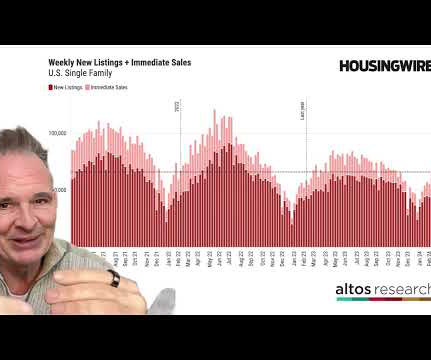

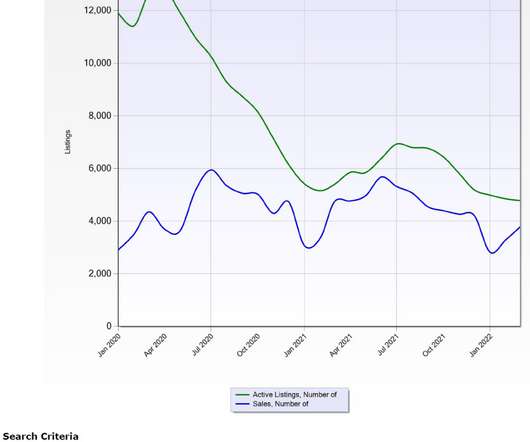

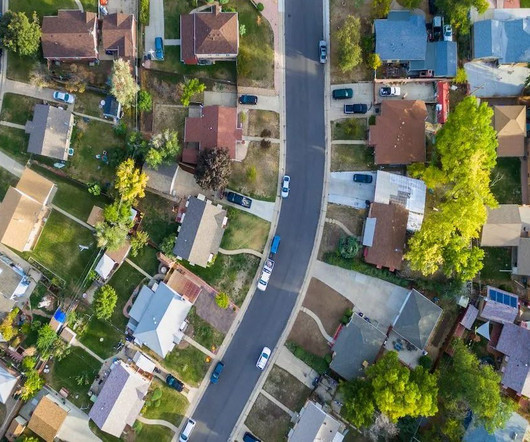

Sluggish net new listings signal that the lock-in effect is not over

Inman

FEBRUARY 5, 2024

percent decline in net new listings and a 2 percent decrease in contract signings, driven by mortgage rate fluctuations, according to HouseCanary. In January, the real estate market saw a 17.5

Let's personalize your content