The housing market is now savagely unhealthy

Housing Wire

MARCH 18, 2022

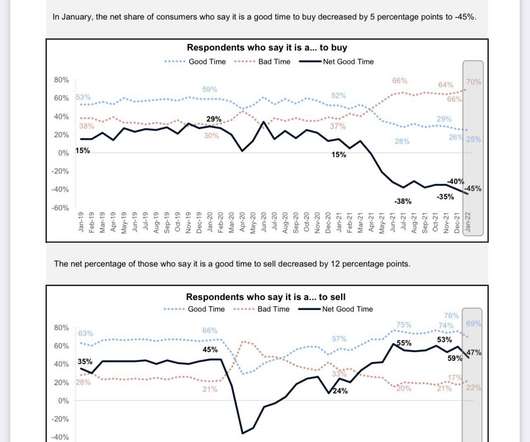

Inventory has been slowly falling since 2014, so if demand picks up in 2020-2024, it can collapse to shallow levels. To get the housing market to be sane and normal again, we need inventory to get back in a range between 1.52 – 1.93 One of the critical data lines that I want to see improve this year is days on market.

Let's personalize your content