Is housing inventory growth really slowing down?

Housing Wire

AUGUST 10, 2022

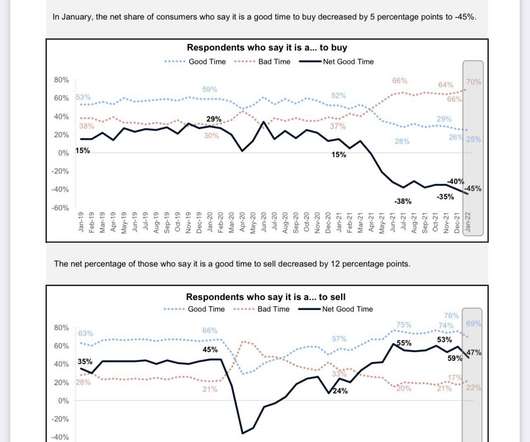

One of the most important housing market stories in recent weeks has been the decline in new listings , which has slowed the growth rate of total inventory. Once that happens, I can finally take the savagely unhealthy housing market theme off my talking points. What does this mean? million to 1.93

Let's personalize your content