Typical homebuyers made $107,000 annually, used a real estate agent in 2023: NAR survey

Housing Wire

NOVEMBER 13, 2023

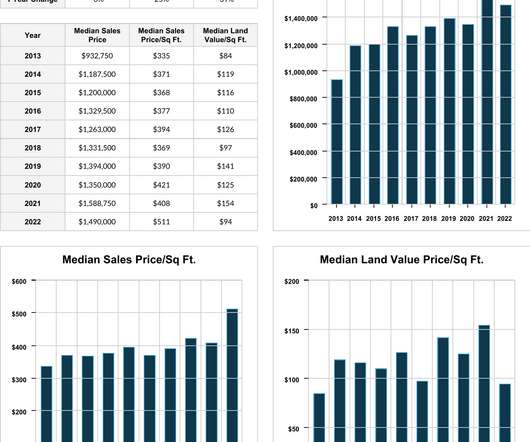

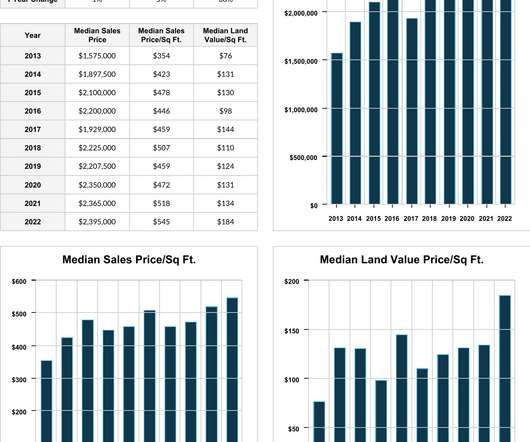

“Given the erosion of housing affordability due to higher home prices and mortgage rates , the household income for those who successfully purchased homes jumped by nearly $20,000 and topped six figures for only the second time in our records,” Jessica Lautz, NAR deputy chief economist and vice president of research, said in a statement. “In

Let's personalize your content